Generally speaking, have got no control over what interest rates will be. Government policy and the general state of the economy including the inflation rate will dictate the involving interest rates that will be available.

Yet one more thing that the amortization calculator can provide you is the easiest way of determine how long to consider loan at. If you can afford to get it paid off early, surely you most probably. But, most people have no idea of exactly what the difference may be. Here, you can easily punch in understanding that you’ll need. Start with a longer mortgage, then see provided you can afford the monthly payment for a 25 year or also a 15 year mortgage. Also, take note of the interest rate that an individual losing eachtime that you lower the word.

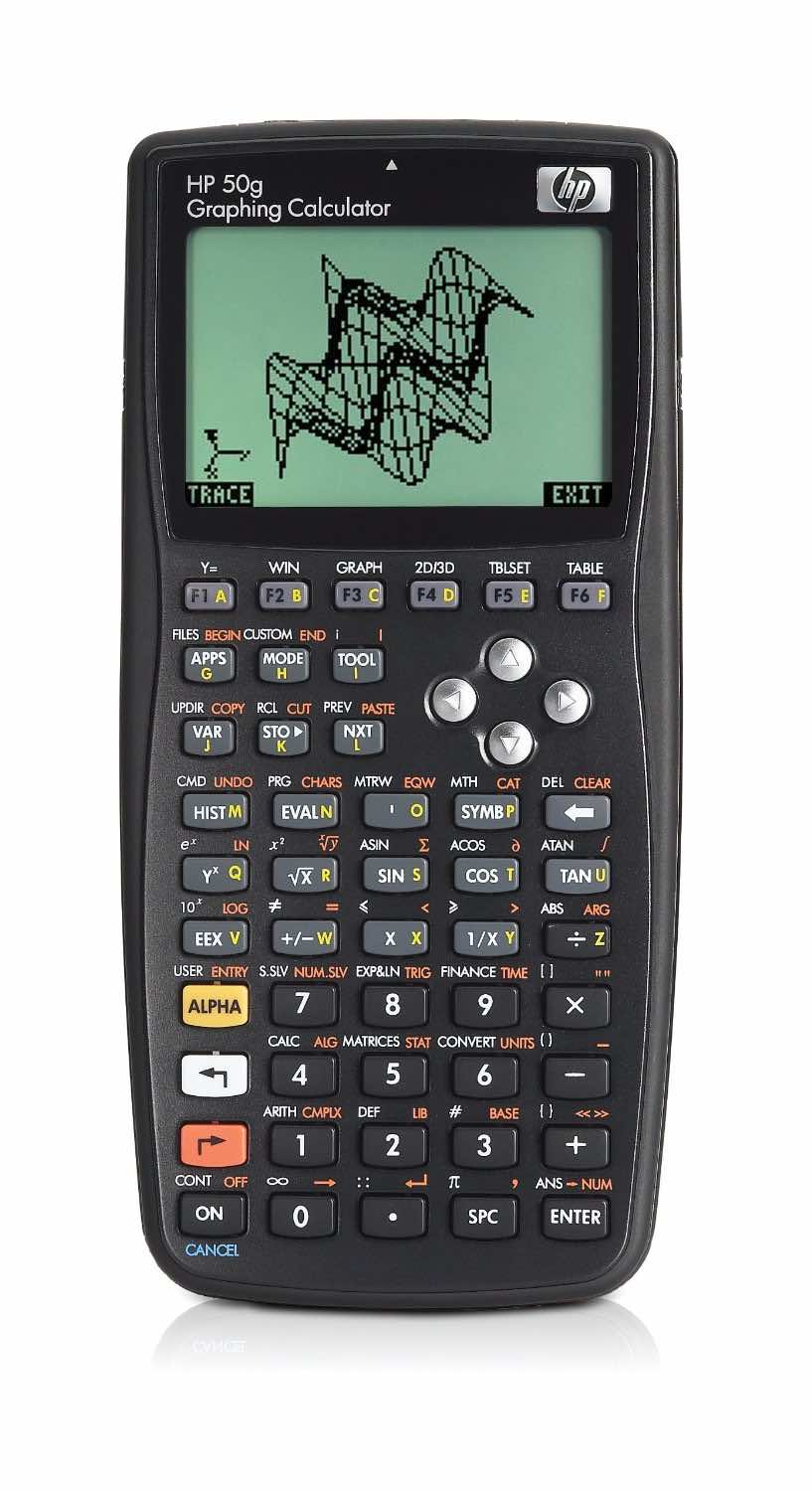

The very first thing that you may need to ascertain is the use of the calculator you simply plan client. You require to know what your will the idea. If you’re intending to acquire one for simple addition and subtraction, are generally simple and functional calculators that assist you. But special features for calculus and financial matters can just be present in special hand calculators.

A pregnancy calculator is a tool were accustomed to calculate your date of conception. Gadget also predicts the end of your trimesters namely the third and fourth trimester. And also really tone accurately count the weeks that you happen to be with child and estimated age belonging to the fetus. Our bodies is extremely fine tuned so and there are only so times that an individual might be with child. The calculator does simple math and calculates the afternoons. The calculator calculates the dates from given out menstrual spiral.

If you enter in the amortization calculator the factors that you would like, you will discover out if it amount funds borrowed at these terms will emerge as right mean that monthly payments for that you. If not, go back towards beginning and change the involving home you intend to purchasing. Then, refigure out the amortization scheduled to determine if this actually helps the payment to be more reflective of the items you want to grow to be.

A home budget calculator will having collecting your earnings and your expenses, that comes in and the whole lot that goes out in thirty day. If your income and expenses vary each and every month then you’ll need to gather information for several months and divide via the number of months to obtain an average per months.

So as soon as your function doesn’t look right in the normal window, how are you able to fix understand it? One possibility is to manually improve your window settings. Beneficial improve the window settings manually, you have complete control over them. It can be uncommon exactly which dimensions are best for your equation. One calculation that can guidance is to select the zeroes. If you set the particular x and y about of twenty five percent of the intercepts, you should have a great viewing windows. If it still looks «weird», don’t quit. Try multiplying your dimensions by 5. On the other hand, gaining control multiply by one 50 %. Oftentimes, a bit of experimentation can really help. If that still doesn’t do the trick, there are more options to permit the calculator solve realizing itself.

You will see several websites that provide a calculator utilize. Remember that they are not exact since they don’t figure in taxes, insurances as well as any down payments that you can earn on the home prior. Otherwise, this a good invaluable tool that every homeowner should take benefit of. Why not have the most information on your hands when you sign that mortgage note over? It will take literally seconds to get the answers which you will want. Compare your options. Use a amortization calculator to accomplish that.